2022 Federal Budget Announcement

31st March 2022

by The Landscape Association

Business Advisors, Hillers Advisors have provided the following information about the recent Federal Budget.

This week, the Australian government announced the new Federal Budget. Small business owners were among the winners of the 2022/2023 budget.

Additionally, there are changes for individuals which may see a reduction in your tax payable

You can read all about these changes and additions below.

Small business technology boost

If the business has turnover of under $50m then you will be able to deduct an additional 20% of expenditure incurred on expenses and depreciation to support digital adoption, up to an annual cap of $100k.

This will be available from 29 March 2022 – 30 June 2023 and the additional claim will be included in the 2023 income year.

Small business skills and training boost

If the business has turnover of under $50m then you can claim an additional 20% of expenditure incurred on eligible training courses provided to your employees. This expenditure will be incurred from 29 March 2022 – 30 June 2024.

While for expenditure incurred prior to 30 June 2022, the additional claim will be included in the 2023 income year, all other expenditure will be claimed in the year incurred.

Varying GDP uplift in PAYG instalments

Normally PAYG installments are based on the prior year’s tax plus 10%. But for the 2023 year this will be reduced to an uplift of 2%.

Grant payments in relation to COVID19

Any grant payments made in relation to COVID19 from 1 July 2020 – 30 June 2022 will be non assessable income.

Grants available to NSW are as below:

Tax deductibility of COVID-19 test

Businesses will be able to deduct the cost for providing employees with COVID-19 test and no fringe benefits tax (FBT) will apply. This will commence 1 July 2021.

Employers engaging apprentices

There have been various measures put in place to support employers that are engaging apprentices. This is to promote skills development and growing Australia’s workforce.

They will:

When it comes to benefits for individuals there were a few key ones:

Cost of living tax offset

The cost of living tax offset was increased from $1080 to $1500 for eligible individuals.

It is important to note this is not a cash hand out, but will result in lower amounts payable and larger refunds when lodging 2022 returns for individuals with an annual income under $126,000.

$250 cost of living payment

People who are already receiving certain Centrelink benefits will receive a $250 tax exempt support payment.

These payments will be made through April 2022.

The payment will be made to eligible Australian resident recipients of the following payments and to concession card holders:

Expansion of first home guarantee scheme

This will increase from 10,000 to 35,000 places to support eligible for home buyers to purchase with a deposit as low as 5%.

Tax deductibility of COVID-19 test

Individuals will be able to deduct the cost of taking a COVID-19 test to attend work. This will commence 1 July 2021.

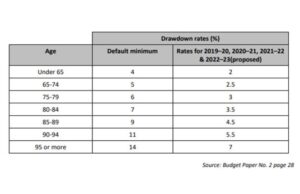

Minimum pension drawdown amounts

Minimum pension drawdown amounts have been reduced by 50% for the 2020, 2021 and 2022 years and has also been extended to apply to the 2023 financial year also.

Please see the table below for more information:

To find out more information please speak with your Accountant. To read the full budget summary for 2022/2023 click here

This information has been provided with permission from Hillers Advisers. You can find out more about their services on their website here.

Comments posted to this page are moderated for suitability. Once your comment has been checked it will be uploaded to the site.